The Of Pvm Accounting

The Of Pvm Accounting

Blog Article

The smart Trick of Pvm Accounting That Nobody is Discussing

Table of ContentsSome Known Details About Pvm Accounting Some Ideas on Pvm Accounting You Should KnowThe 10-Second Trick For Pvm AccountingAll about Pvm AccountingAbout Pvm AccountingThe 6-Second Trick For Pvm Accounting10 Easy Facts About Pvm Accounting ShownSome Of Pvm Accounting

One of the primary reasons for implementing accountancy in building tasks is the requirement for monetary control and management. Audit systems offer real-time understandings into job prices, profits, and success, making it possible for project supervisors to promptly identify prospective concerns and take rehabilitative actions.

Accountancy systems enable companies to keep an eye on capital in real-time, making certain sufficient funds are offered to cover expenses and satisfy economic responsibilities. Reliable cash money flow monitoring helps prevent liquidity situations and maintains the job on track. https://disqus.com/by/leonelcenteno/about/. Construction tasks are subject to different economic mandates and reporting demands. Correct accounting makes sure that all financial deals are videotaped properly and that the project adheres to accounting criteria and contractual agreements.

Not known Facts About Pvm Accounting

This reduces waste and boosts task efficiency. To much better comprehend the significance of accounting in construction, it's additionally vital to identify between building and construction monitoring bookkeeping and task administration bookkeeping. largely concentrates on the financial elements of the construction business as a whole. It manages general monetary control, budgeting, capital monitoring, and monetary coverage for the entire company.

It concentrates on the economic aspects of private construction jobs, such as price evaluation, price control, budgeting, and capital management for a specific job. Both sorts of accountancy are important, and they complement each other. Building administration accounting guarantees the firm's economic health, while project administration accounting makes certain the economic success of individual jobs.

Not known Details About Pvm Accounting

A vital thinker is required, that will certainly deal with others to make decisions within their areas of obligation and to surpass the locations' work procedures. The position will certainly connect with state, college controller personnel, campus department personnel, and academic scientists. This individual is expected to be self-directed once the first understanding curve is conquered.

The Main Principles Of Pvm Accounting

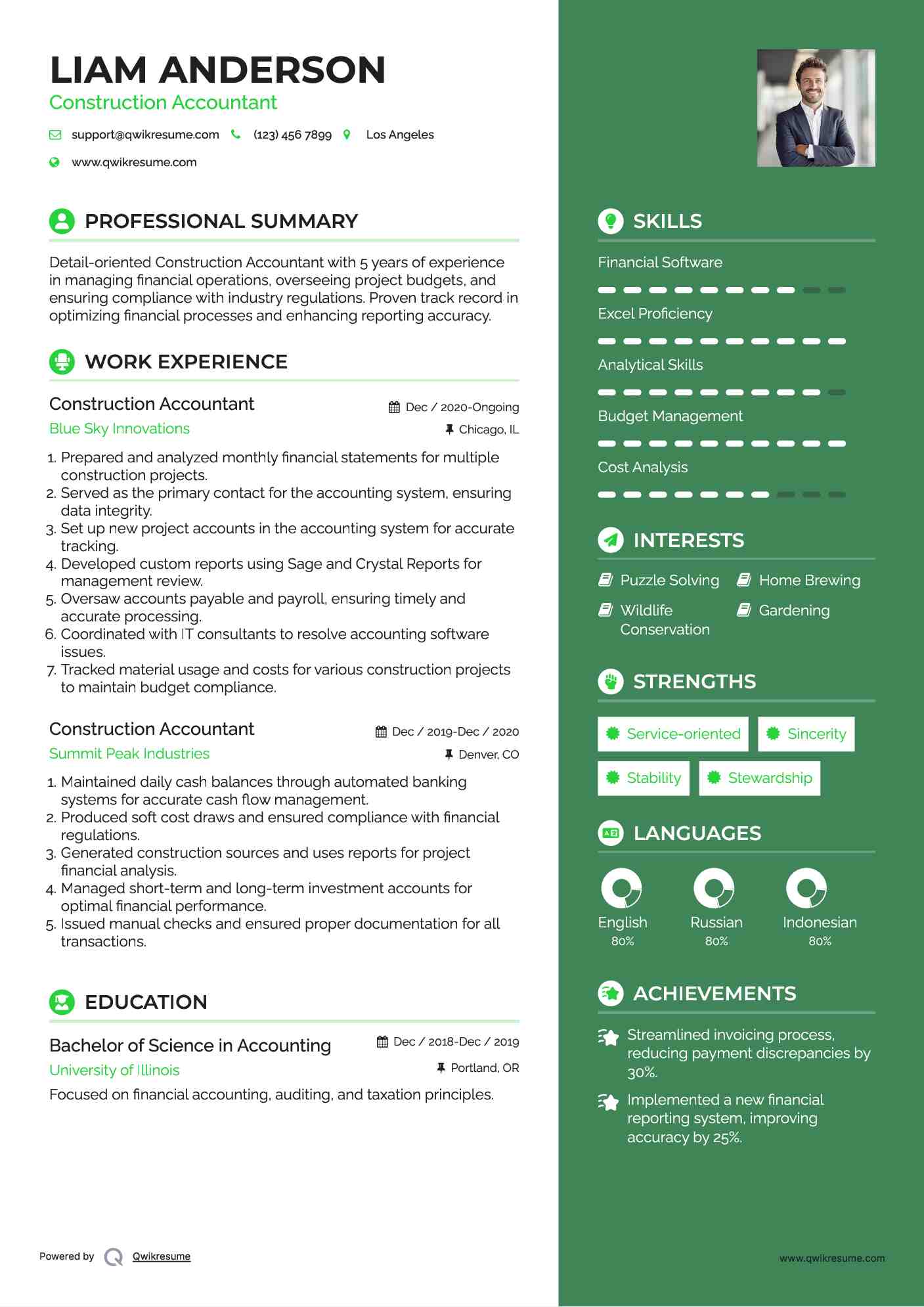

A Building and construction Accounting professional is responsible for handling the monetary facets of building jobs, consisting of budgeting, cost monitoring, financial coverage, and compliance with governing requirements. They function carefully with task supervisors, professionals, and stakeholders to make certain exact monetary documents, cost controls, and prompt repayments. Their knowledge in building and construction accounting principles, task costing, and monetary evaluation is necessary for reliable economic administration within the construction sector.

The Greatest Guide To Pvm Accounting

As you have actually possibly discovered now, tax obligations are an unavoidable part of doing business in the USA. While the majority of emphasis normally pushes federal and state revenue tax obligations, there's likewise a third aspectpayroll tax obligations. Payroll taxes are tax obligations on a worker's gross salary. The incomes from payroll tax obligations are utilized to fund public programs; as such, the funds collected go directly to those programs as opposed to the Irs (IRS).

Keep in mind that there is an additional 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers making over $200,000. Incomes from this tax obligation go toward federal and state joblessness funds to help workers that have lost their tasks.

The Single Strategy To Use For Pvm Accounting

Your deposits need to be made either on a month-to-month or semi-weekly schedulean election you make before each fiscal year. Monthly payments. A regular monthly repayment has to be made by the 15th of the following month. Semi-weekly settlements. Every various other week deposit days depend on your pay schedule. If your payday falls on a Wednesday, Thursday or Friday, your down payment schedules Wednesday of the complying with week.

Take care of your obligationsand your employeesby making complete pay-roll tax obligation settlements on time. Collection and repayment aren't your only tax responsibilities.

Pvm Accounting Can Be Fun For Everyone

Every state has its very own unemployment tax (called SUTA or UI). This is since your firm's market, years in business and unemployment history can all identify the percentage made use of to calculate the quantity due.

The Pvm Accounting Diaries

The collection, remittance and reporting of state and local-level taxes depend on the governments that levy the taxes. Clearly, the topic of pay-roll tax obligations includes plenty of relocating parts and covers a large array of accounting knowledge.

This internet site utilizes cookies to enhance your experience while you navigate with the site. Out of these cookies, the cookies that are classified as essential are stored on your browser as they are vital for the working of standard functionalities of the website. We additionally use third-party cookies that aid us assess and comprehend exactly how you use this site.

Report this page